The Moving Average Convergence Divergence (MACD) is a popular and versatile technical analysis tool used by traders in financial markets. Developed by Gerald Appel in the late 1970s, the MACD helps traders identify trends, momentum, and potential reversal points in stock prices. This article will explore how the MACD indicator works, its components, and how traders can use it to make informed trading decisions.

Components of the MACD Indicator

The MACD consists of three main components:

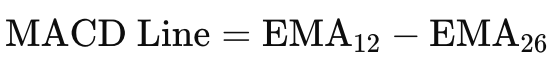

- MACD Line: The MACD line is the difference between the 12-day Exponential Moving Average (EMA) and the 26-day EMA. This line fluctuates above and below a zero line, indicating changes in the market trend.

- Signal Line: The Signal line is a 9-day EMA of the MACD line. It is used to generate buy and sell signals. When the MACD line crosses above the Signal line, it is considered a bullish signal (a buy opportunity). Conversely, when the MACD line crosses below the Signal line, it is considered a bearish signal (a sell opportunity).

- Histogram: The histogram represents the difference between the MACD line and the Signal line. It visually displays the strength and direction of the market momentum. A positive histogram indicates bullish momentum, while a negative histogram indicates bearish momentum.

Calculating the MACD Indicator

The MACD calculation involves the following steps:

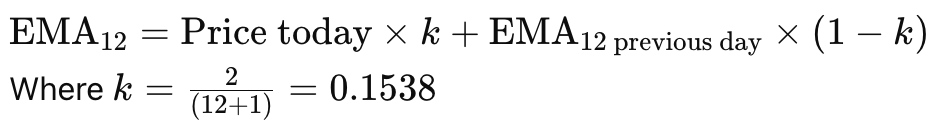

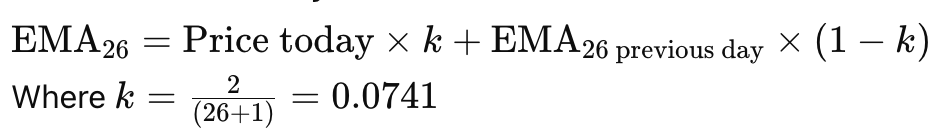

Calculate the 12-day EMA:

Calculate the 26-day EMA:

Calculate the MACD Line:

Calculate the Signal Line:

Calculate the Histogram:

Interpreting the MACD Indicator

Crossovers

The primary signals generated by the MACD are the crossovers between the MACD line and the Signal line:

- Bullish Crossover: Occurs when the MACD line crosses above the Signal line. This suggests that the stock price may be entering an uptrend, providing a potential buy signal.

- Bearish Crossover: Occurs when the MACD line crosses below the Signal line. This indicates that the stock price may be entering a downtrend, providing a potential sell signal.

Divergence

Divergence between the MACD line and the stock price can also provide valuable signals:

- Bullish Divergence: Occurs when the stock price makes a lower low, but the MACD line makes a higher low. This suggests that the downward momentum is weakening, and a reversal to the upside may be imminent.

- Bearish Divergence: Occurs when the stock price makes a higher high, but the MACD line makes a lower high. This indicates that the upward momentum is weakening, and a reversal to the downside may be forthcoming.

Histogram Analysis

The histogram can help traders understand the strength of the market momentum:

- Increasing Histogram: When the histogram bars increase in height, it indicates strengthening momentum in the direction of the MACD line.

- Decreasing Histogram: When the histogram bars decrease in height, it suggests weakening momentum and potential reversal points.

Practical Applications of the MACD Indicator

Identifying Trends

The MACD is particularly useful for identifying the overall trend of a stock. Traders often use the MACD line’s position relative to the zero line to determine the trend direction:

- Above Zero Line: When the MACD line is above the zero line, it suggests a bullish trend.

- Below Zero Line: When the MACD line is below the zero line, it indicates a bearish trend.

Combining with Other Indicators

To enhance the accuracy of their trading signals, traders often combine the MACD with other technical indicators, such as the Relative Strength Index (RSI) or Bollinger Bands. This multi-indicator approach can help confirm signals and reduce the likelihood of false signals.

Conclusion

The MACD indicator is a powerful tool for traders looking to identify trends, momentum, and potential reversal points in stock prices. By understanding its components and how to interpret its signals, traders can make more informed decisions and improve their trading strategies. However, like any technical analysis tool, the MACD should be used in conjunction with other indicators and analysis methods to maximize its effectiveness.